In spite of present economic challenges, some Economic Analysts are confident that Ghana is still competitive among her neighbours and remains one of the best terrains for business.

In spite of present economic challenges, some Economic Analysts are confident that Ghana is still competitive among her neighbours and remains one of the best terrains for business.

The current crisis, according to them can be resolved very quickly, if the country’s expenditure patterns are well managed.

“Government expenditure is too high, we need to put together a national alliance for resolving these problems”, analysts say.

They maintain that Ghana can still expect to earn a lot from cocoa, gold and other exports and once the fiscal deficit situation is addressed, these commodities could bring in revenue for the government.

Ghana’s deficit has been driven past 10%, a level which has attracted concern from her development partners.

The World Bank’s observation of the country’s economy reflects evaluation made by other institutions, including the International Monetary Fund (IMF), that suggests that unless the current macroeconomic challenges were dealt with, the country may not achieve the 8.5 per cent fiscal deficit of GDP target for this year.

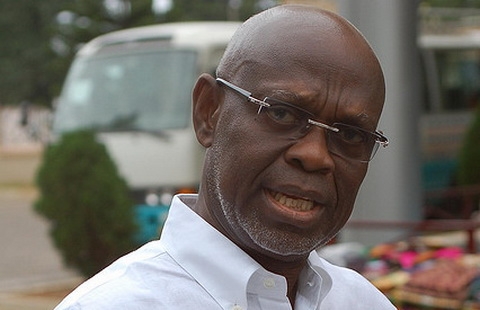

Economist and investment consultant, Mr Kwame Pianim is hopeful that cocoa gold and other exports including horticulture, tourism, services will continue to bring in the much needed revenue .

According to him, there is no need to worry about the exchange rate volatility because “it can be resolved very quickly once the fiscal deficit issue is addressed.”

The Ghanaian economy has since the beginning of this year gone through a lot of downturns, making the country less attractive to foreign investors.

Mr Pianim however bemoans the loss of policy credibility, a situation he describes as unhelpful and a disincentive to the business environment.

“Nobody believes our policies any-more and we need to come up with a framework that will indicate to investors and the business community that our policies are credible, they are sustainable and are predictable to allow for planning,” he maintains.

He points to existing infrastructure for business which according to him is “disruptive of economic growth.”

“If you have your lights and therefore your equipment going on and off, manufacturing is a problem,” he notes.

Investor decisions are largely based on market potential, access to finance, reliable electricity supply and good infrastructure among others.

The cumulative impact of tax policies on businesses and the capacity of Ghanaians to contain the gravity of the taxes being imposed by government are major drawbacks on the investment climate in the country.

Even though investors pay attention to the tax regime, analysts believe that relatively higher regional or national taxes may be acceptable or even competitive if investors see them compensated or offset by higher levels and quality of public services and infrastructure.